Why EC is a MUST invest if you are eligible for it?

You have probably through hearsay or reading somewhere that buying an EC (Executive Condominiums) is a great idea.

Why is it such a great idea?

Why don’t everyone invest in it if it is such a great idea?

Why are there so many ECs still unsold in the current market if it is such a great idea?

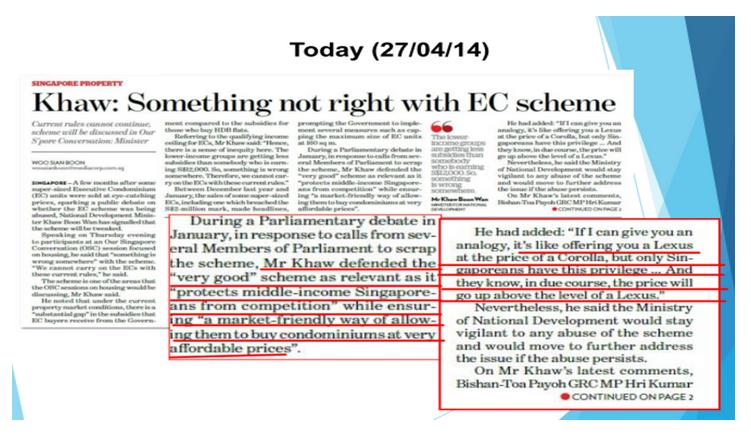

First and foremost, you will need to know that EC was created for the sandwiched income class who exceed BTO income cap of $12K and face difficulty in affording a full privatised condo as well. Therefore government sells subsidized land to private developers who in turn build and translates the subsidized cost on to buyers. The best thing now is that EC will become semi-privatised after 5 years upon TOP (Eligible for sale to PR and Singaporean), fully privatised after 10 years upon TOP(Eligible for sale to foreigners on top of the previous categories) and the value of the unit is likely to go up substantially due to substantial difference between EC and private condos.

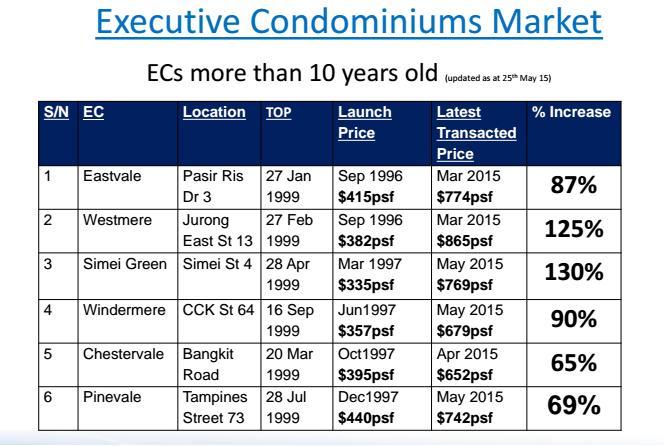

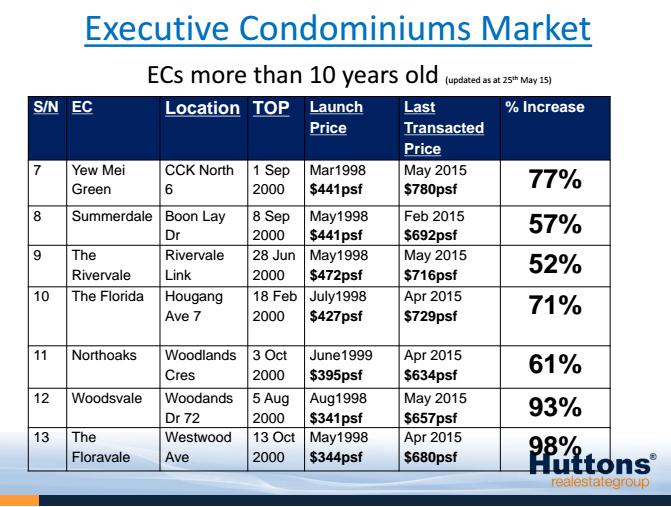

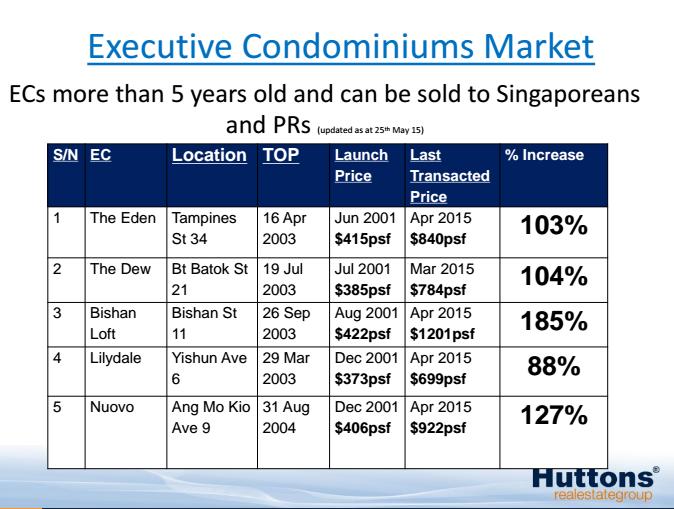

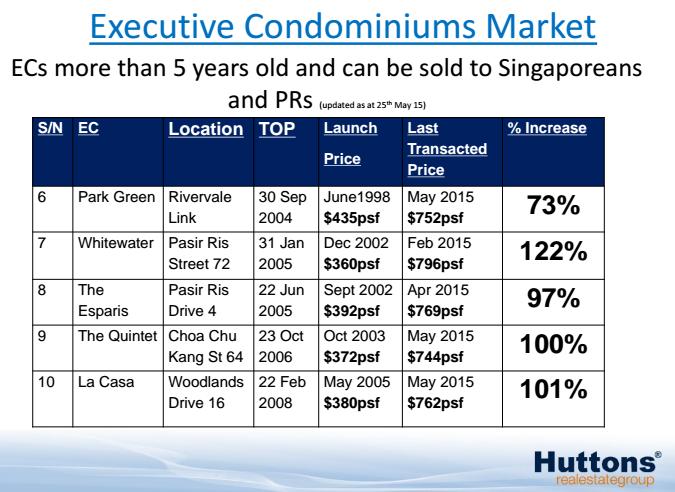

The best form of evidence on this statistics is on historical transactions. Looking at the appended charts, you can see for yourself historical appreciation on executive condominiums.

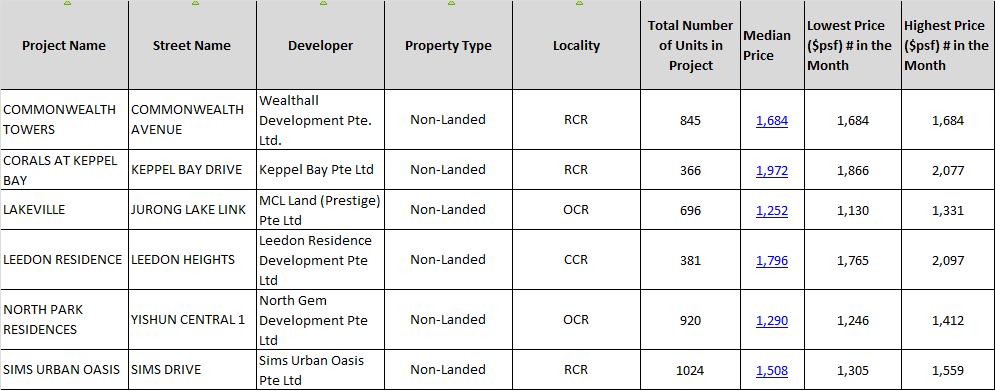

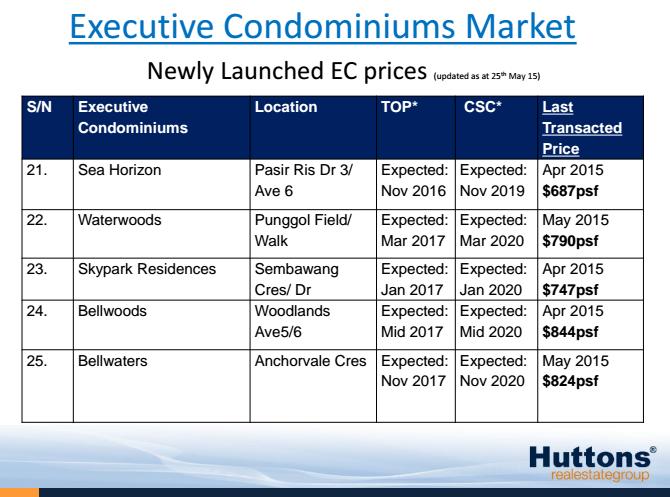

After taking a look at historical appreciation on EC, lets take a look at the current private condo pricing vs current EC pricing.

Prices of current Private Residential Units sold by Developers retrieved from URA portal:

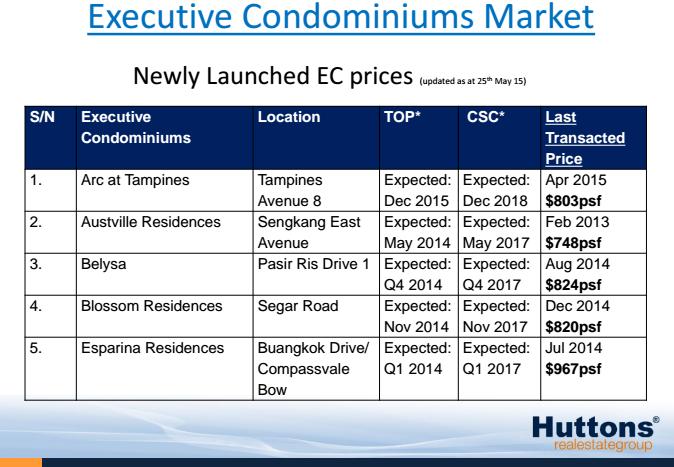

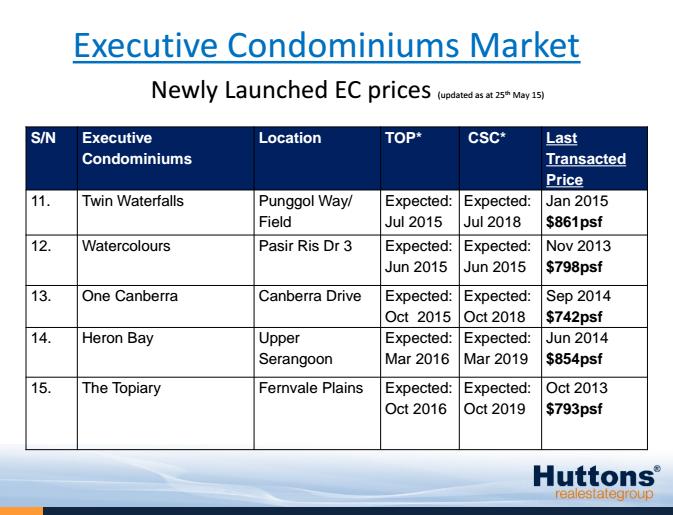

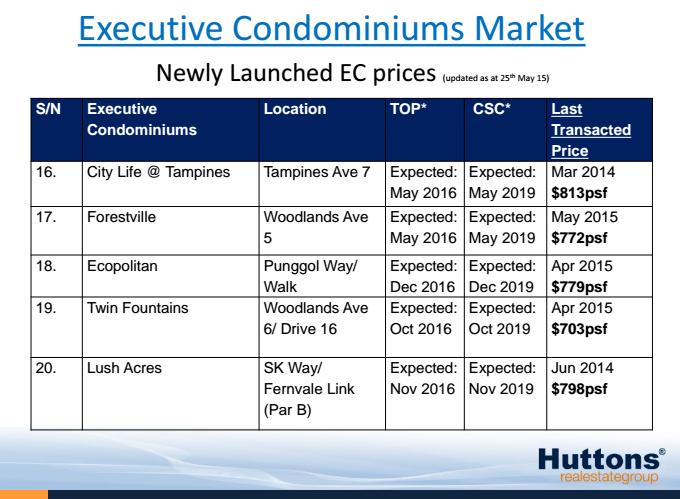

Recent times EC transactions

Just based on the above statistics, you can see that the PSF difference between current market executive condominiums and private condominiums is already well over 20% and more. This is almost likens to an on paper appreciation not taking into account of the 5 years minimum occupation period for EC buyers. What’s more, first time buyers can still enjoy up to max $30K grant while doing the purchase!

This then leads to our 2nd and 3rd questions.

This then leads to our 2nd and 3rd questions.

Why don’t everyone invest in it if it is such a great idea?

Why are there so many ECs still unsold in the current market if it is such a great idea?

Well, the most obvious answer is that not everyone is eligible to buy EC. Basically, only Singaporean based family nucleus within the limited income cap of $14K can be eligible for the purchase up to 2 times. The buyers must not also own any private properties both locally and overseas or have not disposed any of such private properties previously within a 30 months time frame.

Refer to this EC eligibility checklist to check if you might qualify. =>EC Eligibility Link

The other major obstacle other than these stringent qualification terms is with regards to loan. To encourage financial prudence when doing purchase, the Monetary Authority of Singapore (MAS) have recently cap the Mortgage Servicing Ratio (MSR) for housing loans granted by financial institutions for EC units bought directly from property developers at 30% of a borrower’s gross monthly income.

This is in line with earlier measures introduced by the HDB and MAS to encourage financial prudence among buyers of public housing. It discourages EC buyers from over-stretching their finances and supports an affordable and sustainable EC market. To put in layman terms, this means that buyers will be limited to using 30% of their income for servicing monthly mortgage.

When I put it to example, a young couple with a household combined salary of $5,500 with no other financial liabilities can only borrow up to estimated $367,499 for a 30 years loan. If this young couple wishes to make a purchase for a $700,000 3BR EC unit, it means that they have to fork out well over $300K plus of cash and CPF to fund the purchase. However, if this young couple would be confident with means to greatly increase their monthly income over the next 2/3 years before the EC TOP (Handing of keys), they can also consider going for a Deferred Payment scheme to push back balance funds aside initial 20% outlay to TOP(Normally 2/3 years after initial sales launch). Then as long as they have secured their initial 20% payment, they can secure their loan subsequently closer to TOP period when their loan quantum might have been greatly boosted after 2/3 years. But do note that Deferred Payment Scheme will typically result in around 3% higher in overall pricing compared to Normal Payment Scheme.

In another example, a family of HDB upgraders would wish to upgrade to EC but faces the same difficulty in obtaining enough loan for the purchase. The good news for this family would be that they can potentially leverage on a percentage of their potential future proceeds from their HDB sale to be recognized to push up their loan in the form of a bridging loan (Only certain banks can do this). The major advantage of doing this is that buyers can then push up their loan closer to 80% and free more CPF for usage in their initial 20%, thus using less cash outlay. However, to opt for this method would means that the buyers have to opt for the more expensive deferred payment scheme and have a timeline to sell their HDB before their EC TOP.

In summary, property is a long term investment. In land scare Singapore, the value should appreciate if your time horizon is at least a decade from now. The potential for EC would even be higher due to the initial investment outlay differences from a private condo. If buying an EC unit is within your financial means, my suggestion is to go ahead and book a unit if it that meet your needs. Then while you stay in your dream home, you can leverage on its capital appreciation potential to the future whether or not if you wish to upgrade or cash out in the long term.

To discuss in more details on this context or have a non obligatory consultation session, please feel free to call or whatsapp me.

Associate Senior Marketing Director

(CEA Reg No R049737E)

Huttons Asia Pte Ltd (L3008899K)

[Mobile]: (65) 9455 8898

[eMail]: [email protected]